The Nigeria Deposit Insurance Corporation (NDIC) has called for enhanced collaboration with the Economic and Financial Crimes Commission (EFCC) in furtherance of its statutory mandate and the collective goal of safeguarding Nigeria’s financial system.

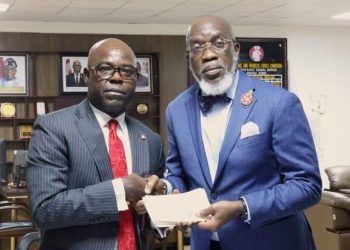

The call was made on Friday, January 23, 2026, when the Managing Director and Chief Executive of the NDIC, Mr. Thompson Oludare Sunday, led members of the Corporation’s management team on a courtesy visit to the Executive Chairman of the EFCC, Mr. Ola Olukoyede. The development was disclosed in an official statement issued by the EFCC’s spokesperson, Mr. Dele Oyewale.

Speaking during the visit, Mr. Sunday described the engagement as an opportunity to formally strengthen institutional ties and deepen operational synergy between both agencies. He noted that the EFCC has remained a dependable partner to the NDIC over the years, stressing the need to expand and consolidate that relationship for greater impact.

According to him, the NDIC is seeking to leverage the EFCC’s technical expertise in asset tracing, recovery and management, particularly in matters involving debtors of banks in liquidation. He explained that the Commission’s experience in these areas has continued to add significant value to the Corporation’s recovery efforts.

Mr. Sunday further emphasized the NDIC’s strategic responsibility in prosecuting individuals whose actions contribute to bank failures, noting that closer collaboration with the EFCC in this critical area would enhance accountability and strengthen confidence in the financial system. He expressed optimism that an expanded partnership between both institutions would further promote financial stability and economic resilience.

In his response, the EFCC Chairman, Mr. Ola Olukoyede, acknowledged the longstanding relationship between the two agencies and pledged to further strengthen the collaboration. He described the NDIC and EFCC as “inseparable twins” that have worked together for years in a mutually beneficial partnership.

Mr. Olukoyede recalled that while the EFCC has supported the NDIC in the area of investigations, the NDIC has, in turn, supported the Commission through capacity building and training. He assured the NDIC management that the EFCC remains committed to taking the partnership to a higher level and sustaining the productive working relationship.

Elaborating on the future direction of the collaboration, the EFCC Chairman stated that his policy focus is to deploy the anti-corruption fight as a tool for stimulating the Nigerian economy, strengthening productive institutions and enhancing the capacities of government agencies through targeted interventions.

He explained that this approach informed the establishment of a new department within the EFCC, the Fraud Risk Assessment and Control Department, aimed at proactively identifying and mitigating fraud risks rather than merely reacting after financial losses have occurred. According to him, the goal is to work closely with stakeholders across the financial ecosystem to strengthen internal processes and ensure a cleaner, more resilient financial environment.

Mr. Olukoyede подчеркed that the NDIC is a key player in this effort and reaffirmed the EFCC’s readiness to collaborate closely with the Corporation in achieving shared objectives of transparency, accountability and financial system stability.