By Nkechi Eze

The Executive Chairman of the Economic and Financial Crimes Commission (EFCC), Mr. Ola Olukoyede, has charged the management of Moniepoint Microfinance Bank to place strict regulatory compliance at the centre of its operations in order to safeguard the integrity of Nigeria’s financial system.

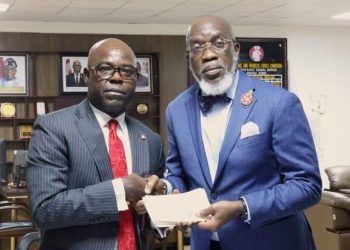

Olukoyede gave the charge on Thursday, January 22, 2026, when the management of Moniepoint, led by its Founder and Chief Executive Officer, Mr. Tosin Eniolorunda, paid him a courtesy visit at the EFCC headquarters in Jabi, Abuja. The visit provided an opportunity for engagement on the responsibilities of fintech institutions in preventing financial crimes and strengthening public confidence in digital financial services.

The EFCC Chairman stressed that due diligence must remain a core operational principle for fintech companies, noting that adherence to regulatory standards would not only strengthen Moniepoint as an institution but also make it difficult for criminal elements to exploit its platform for money laundering, terrorism financing, or other illicit activities. He cautioned that sustaining a successful business required discipline, patience, and strict obedience to the law.

According to him, compliance with extant regulations, particularly those issued by financial sector regulators, was non-negotiable. He urged the company’s leadership to consistently play by the rules and maintain a culture of doing the right thing, regardless of the pressures associated with growth and expansion.

Olukoyede further underscored the importance of Know Your Customer (KYC) processes, especially in the context of evolving regulations around digital finance and cryptocurrency. He noted that KYC requirements issued by regulatory bodies such as the Central Bank of Nigeria and the Securities and Exchange Commission were critical tools in curbing financial crimes and must be taken very seriously by operators in the fintech space.

While issuing the caution, the EFCC boss commended Moniepoint’s management for its resilience, courage, and determination in building and sustaining a business in Nigeria’s challenging operating environment. He described the feat of growing an enterprise capable of employing staff and providing services at scale as deserving of recognition, noting that such success reflected commitment and perseverance.

In his response, Moniepoint’s Founder and Chief Executive Officer, Mr. Tosin Eniolorunda, assured the EFCC Chairman of the bank’s unwavering commitment to regulatory compliance and the safety of all financial activities conducted on its platform. He stated that the company fully understood its growing impact on society and the accompanying responsibility to uphold robust compliance, anti-fraud, and anti-money laundering frameworks.

Eniolorunda explained that Moniepoint had evolved significantly over the years, moving through its early growth and learning phases into a stage of operational maturity. According to him, this evolution has enabled the company to confront and mitigate fraud risks that previously posed serious challenges to the fintech ecosystem.

He added that the bank had instituted stringent verification processes to ensure that account holders were the genuine owners of the accounts they operated. He also highlighted the broader impact of Moniepoint’s solutions, noting that its platforms have improved payment reliability for businesses, expanded access to credit, and supported everyday commercial activities across the country.

The engagement underscored the EFCC’s commitment to proactive collaboration with financial institutions, particularly fintech operators, in promoting compliance, preventing financial crimes, and ensuring that innovation in the financial sector aligns with national laws and global best practices.