…as DCG ICT reaffirms commitment to seamless financial integration

By Nkechi Eze

Nigeria Customs Service intensifies stakeholder engagements to solidify gains and enhance integration of its Unified Customs Management System, B’odogwu, after successful deployment.

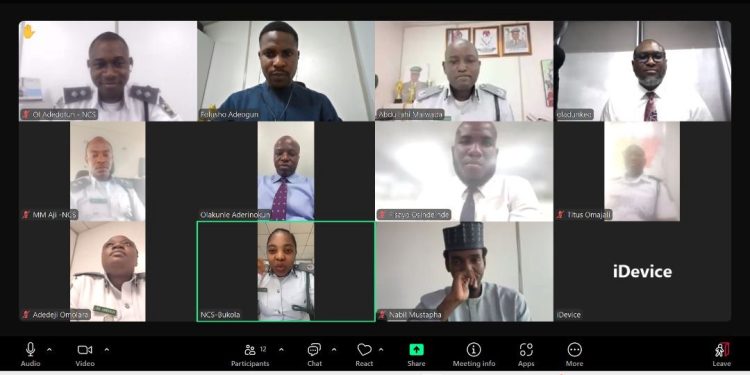

At a virtual meeting held on Monday, April 14, 2025, the NCS leadership, led by Deputy Comptroller-General of Customs in charge of ICT and Modernisation, Kikelomo Adeola, engaged top officials of Access Bank on aligning operational frameworks to support seamless financial transactions and digital trade facilitation.

Led by the Deputy Comptroller-General of Customs in charge of ICT and Modernisation, Kikelomo Adeola, the session also included the Service’s National Public Relations Officer, Assistant Comptroller Abdullahi Maiwada, and Assistant Comptroller Bukola Omoniyi from ICT/Modernisation Department.

The engagement focused on enhancing synergy between Customs and the financial sector, particularly in streamlining payment systems, boosting data exchange, and ensuring real-time processing of trade-related transactions through the B’odogwu platform.

During the meeting, DCG Adeola reaffirmed the Service’s commitment to seamless stakeholder integration in the post-deployment consolidation phase.

“The deployment of B’odogwu marks a new era in Customs administration,” she said. “Our next priority is to strengthen partnerships with financial institutions like Access Bank to fully unlock the platform’s potential for automation, transparency, and trade efficiency.”

She added that B’odogwu, developed as an indigenous solution, has already transformed Customs operations by unifying procedures, automating declarations, and enabling real-time transaction monitoring.

“To achieve optimal functionality, all players within the trade value chain must be fully integrated. This engagement with Access Bank is not just timely—it is strategic,” she noted.

In response, Olatunbosun Oladunke, Head of Global Trade at Access Bank, commended the NCS for its forward-thinking digital transformation and assured the Bank’s support.

“The B’odogwu platform represents a major leap in digital trade processing. Access Bank is fully aligned with the NCS vision and is committed to ensuring system compatibility—particularly in trade finance and payment automation,” he said.

Also. Olakunle Aderinokun, Head of Media and Public Relations at Access Holdings/Access Bank, stressed the importance of stakeholder engagement and public awareness.

“Public buy-in is critical to the success of any reform. We will collaborate with the Service to drive awareness of B’odogwu and educate stakeholders on the value it brings to the trading ecosystem,” he stated.

The engagement is part of NCS’s broader post-deployment strategy to accelerate its trade modernization agenda through stakeholder partnerships, innovation, and enhanced transparency.

With B’odogwu now operational, the NCS is steadily advancing toward a fully digital, integrated, and globally compliant Customs system that supports Nigeria’s economic growth.