By Nkechi Eze

The Nigerian insurance sector is set for a new wave of transformation as the National Insurance Commission (NAICOM) and the FinTech Association of Nigeria strengthened ties yesterday in Abuja, with both parties pledging to harness technology, innovation, and strategic partnerships to revolutionize the industry.

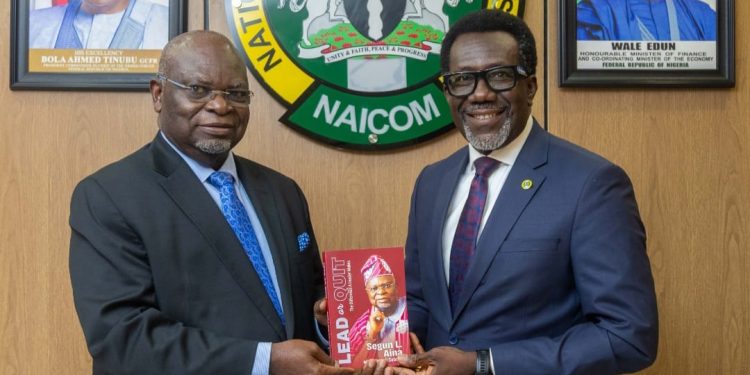

At the high-level meeting, the Commissioner for Insurance, Mr. Olusegun Ayo Omosehin, underscored the centrality of digital adoption in reshaping Nigeria’s insurance ecosystem, stating that technology remains the critical lever for transparency, efficiency, and wider inclusion. He assured stakeholders that under his leadership, the Commission is fully committed to positioning the insurance sector at the forefront of Nigeria’s ongoing digital revolution.

“The future of insurance in Nigeria rests on our ability to embrace innovation and digital transformation. Technology must not be an afterthought but an integral driver of how we deliver products, build trust, and protect policyholders. Our administration is determined to lead this charge by setting standards that ensure the sector meets both global best practices and the expectations of Nigerians,” Omosehin declared.

The Commissioner highlighted NAICOM’s broader reform agenda, which includes rebuilding public confidence in insurance services, safeguarding the interests of policyholders, and promoting financial inclusion through transparent, customer-focused digital solutions. He stressed that the adoption of technology will not only address existing challenges in product distribution and claims management but also open up new opportunities for growth, particularly among underserved populations.

In his remarks, the President of the Africa FinTech Network, Segun Aina, who represented the FinTech Association of Nigeria, expressed strong commitment to supporting NAICOM’s modernization drive. He emphasized that the Association’s members bring cutting-edge expertise in digital finance, data analytics, and user-centric innovation, which can help unlock the vast potential of Nigeria’s insurance market.

“Insurance and technology must go hand in hand if we are to achieve the scale and efficiency required to serve Nigerians better. The FinTech community stands ready to partner with NAICOM to deepen penetration, simplify processes, and create solutions that speak directly to the realities of our people. Together, we can transform insurance from a low-trust, low-penetration industry into a vibrant pillar of Nigeria’s financial system,” Aina noted.

The discussions highlighted key priority areas such as leveraging mobile technology to expand access, integrating artificial intelligence and data-driven tools to enhance risk assessment and fraud detection, and developing digital distribution platforms to bring insurance closer to the grassroots. Both parties also emphasized the importance of strong regulatory frameworks and continuous stakeholder engagement to ensure that digital solutions remain safe, inclusive, and sustainable.

A major outcome of the meeting was the mutual agreement to maintain continuous collaboration between NAICOM and the FinTech Association of Nigeria, fostering an ecosystem where innovation is encouraged, risks are managed, and consumers are adequately protected. Stakeholders present described the engagement as a timely step that aligns with the government’s broader digital economy agenda and Nigeria’s Vision 2030 aspirations.